Global Smartphone Production Declines, Transsion Rises, Apple and Samsung Compete

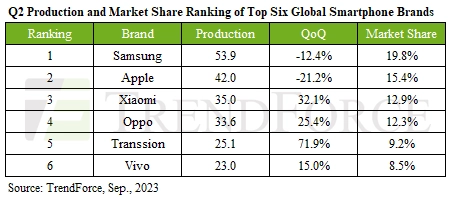

Global smartphone production experienced a decline of 6.6% in Q2, settling at 272 million units. This decline is part of a larger trend, with the first half of 2023 seeing a 13.3% year-on-year decrease in production.

However, amidst this downturn, Transsion, which includes brands like TECNO, Infinix, and itel, managed to secure the fifth spot in global rankings for the first time, with Q2 production surging by over 70%.

Meanwhile, leaders Samsung and Apple faced their own challenges, with a downturn in production.

This article delves into the factors behind the decline, Transsion’s rise, and the competitive battle between Apple and Samsung.

The Decline in Global Smartphone Production

Global smartphone production has experienced a decline of approximately 6.6% in Q2, settling at 272 million units. This decline is part of a larger trend, with the first half of 2023 seeing a 13.3% year-on-year decline in smartphone production.

Despite the easing of pandemic restrictions in China, there has not been a significant increase in demand. Additionally, the emerging Indian market has not translated into tangible demand for smartphones.

However, one notable exception to this decline is Transsion, which includes brands like TECNO, Infinix, and itel. Transsion secured the fifth spot in global rankings for the first time, with a Q2 production surge of over 70%. This increase can be attributed to inventory replenishment, new product launches, and their entry into mid-to-high-end markets.

Overall, the decline in global smartphone production raises concerns about the future of the industry and suggests that further reductions may occur in the second half of the year.

Transsion’s Rise in the Global Market

Securing the fifth spot in global rankings for the first time, Transsion’s entry into the global market was driven by significant production growth and successful expansion into mid-to-high-end markets.

In Q2, Transsion (including TECNO, Infinix, and itel) experienced a remarkable surge of over 70% in production. This impressive performance was attributed to inventory replenishment, new product launches, and an effective strategy to capture the mid-to-high-end market segment.

As a result, Vivo slipped to the sixth position in global rankings, facing challenges in a sluggish global economy. Although Transsion’s rise is notable, it is still behind industry leaders like Samsung and Apple.

However, with its strong production growth and entry into new market segments, Transsion is poised to continue its upward trajectory in the global smartphone market.

Apple and Samsung’s Competitive Battle for Market Leadership

Despite facing a 12.4% QoQ downturn in Q2, Samsung remains a formidable competitor in the battle for market leadership against its rival. Apple’s Q2 production also experienced a significant dip of 21.2% due to the transition between older and newer models.

However, both companies are still neck-and-neck in their annual production projections. The upcoming iPhone 15 series could have a significant impact on Apple’s Q3 production performance, potentially narrowing the gap with Samsung.

It is worth noting that Xiaomi and Oppo had strong Q2 performances with seasonal upticks of 32.1% and 25.4% respectively. Despite the uncertain economic recovery and the global decline in smartphone production, Samsung’s enduring presence and Apple’s upcoming product launch suggest that the battle for market leadership will continue to be intense.